In Part 1 of our recap of the panel discussion hosted by Munich Re Life US – The Financial & Operational Benefits of AI-Powered Claims Guidance – we heard about the triple win generated when the C-suite, claims departments, and risk actuaries team up to deliver significant financial and organizational impact. But the participants also stressed how AI-powered claims guidance is more than just a bottom-line solution.

In today’s Part 2, we’ll hear the panelists’ perspectives on some common barriers to adopting new technology – and what convinced them to deploy the software.

As Kara Hoogensen, Senior Vice President at Principal Financial Group, said in the discussion: “I can still remember the excitement I felt when my claims leader team shared the early results from our proof-of-concept with me and some of the other leaders in our business and my response back to them is, ‘How quickly can we implement?’ And that has certainly carried through to this day as we’re continuing to deploy the capability across different disability products lines at Principal.”

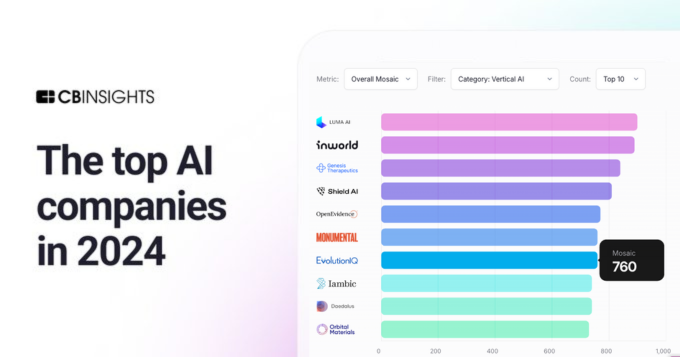

Thomas Lutter, CFO, Reliance Standard Life, also underscored how traditional roadblocks to technology adoption didn’t materialize when it came to the software: “One of the initial barriers in the group insurance space is certainly the availability of data. I think that’s been important and it’s been something across the industry that’s been enhanced. But EvolutionIQ came to the table with solutions for that. And the ability to work and tie all that together without compromising the integrity of a particular company’s data – to really help with the solution – I think that was one of the things they recognized upfront.”

- Click here to read and watch Part 1 of the Munich Re panel recap

- Click here to read our post about the strategic partnership between Munich Re US and EvolutionIQ that’s designed to help the companies it reinsures modernize their claims processes