What’s changing about AI and how are Insurtech’s impacting the industry?

Artificial Intelligence has been a buzzword in the Insurance industry for over a decade, but in the minds of many executives it failed to live up to the hype and deliver the promised impact. However, over the last several years advancements in AI have provided much greater ROI and are now solving some of the most complex challenges of the insurance industry.

This is largely due to “Mission Driven AI” – Insurtechs building completely integrated products that leverage AI to solve specific problems. These venture-backed startups are able to attract the world’s best technical talent to invest more in specific challenges than a carrier or internal data science team could with more narrowly-scoped focus and specialization than organizations like McKinsey and IBM. The results speak for themselves: faster and cheaper AI that generates better ROI than that of previous generations.

Impacting the Bottom Line with AI

The advancements in AI and its application have dramatically changed over the last decade. Most of the early efforts, still popular today, were types of Robotic Process Automation (RPA). This technology was particularly effective at automating simple, repetitive tasks which primarily led to efficiency and expense reduction in the organization. However, the cost savings didn’t provide meaningful competitive advantage as these mundane tasks were usually performed by a small team of junior staff members. While basic automation is a must, the expense savings rarely moved the bottom line and there was little to no impact on loss ratios.

AI modeling was the next technology to pique carrier interest, starting with underwriting and pricing and only recently making its way into claims, the largest remaining area of opportunity to impact insurance company performance. These newer initiatives are focused on analyzing, predicting and prioritizing the data that exists within the carrier. In a hyper-competitive market like insurance, it’s important to contemplate what will ultimately drive differentiated value. The three core elements of these AI systems are: infrastructure, models and data.

Changing Behavior and Outcomes Through Data

Each carrier has unique data that should drive its differentiation, but the limiting factor has largely been accessibility of data within their organizations. The initial challenges of storage and digitization were largely addressed by massive investments in core systems over the last decade. The more recent challenge is that the majority of the information existing within insurance companies is in unstructured claim notes (read more about unstructured data here). Most of the investment in analyzing this text is focused on keyword search to enable rule-based systems that often create false-positive flags. These systems will not be able to take the next step to drive quantifiable impact on the claims without massive investments in NLP and feature engineering of free form text as it represents north of 80% of the context and process of claim handling..

In many cases the models predicting severity and risk for carriers were black boxes, providing a score with little more. This furnished claims handlers with a prioritized list of claims and gave them little trust in the system. As a result, staff combed through years of claim history just to validate the model output negating any expense impact. With no investments in change management and product development for end users, these advancements in modeling failed to live up to their promise of impacting losses.

However, more recent approaches have provided so much more. Understanding the time series of information in a claim from the notes (unstructured data), allows AI to recommend specific actions (read more about time series claim analysis here) such as when in the claim lifecycle it should have been referred to a specialist or investigator, which claimants under what circumstances are more open to settlement, and what actions of the claims handler ultimately drive impact on the claim. Ultimately, the AI can learn to consistently recommend what the claim handler should do next to drive the best claim outcome for all parties. Companies are able to dive deeper into the specific actions, and resulting impact, when AI understands the notes and documents to derive best practices around claims handling.

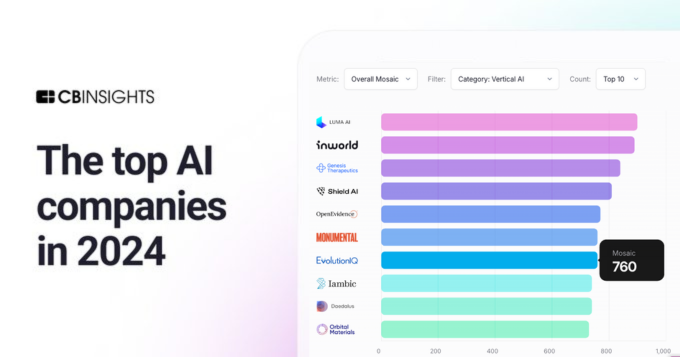

The Golden Age of Insurtechs

The new generation of AI will provide billions of dollars of savings and impact hundreds of basis points of combined ratios. This pursuit is being led by Insurtechs for a few key reasons. First, this type of AI necessitates investments across front end product, back end infrastructure and data science resources requiring tens, if not hundreds, of millions of dollars to tackle over the next decade. Additionally, these more complex challenges will be solved by the leading minds in AI and technology (read more about recruiting challenges in the Insurance industry). This scale of ongoing investment is only possible when the cost can be distributed across the industry. The economics of these software companies allow them to invest heavily while providing more targeted and advanced technology at a cheaper price.